Spend smart with 0% interest, EMIs, and credit growth

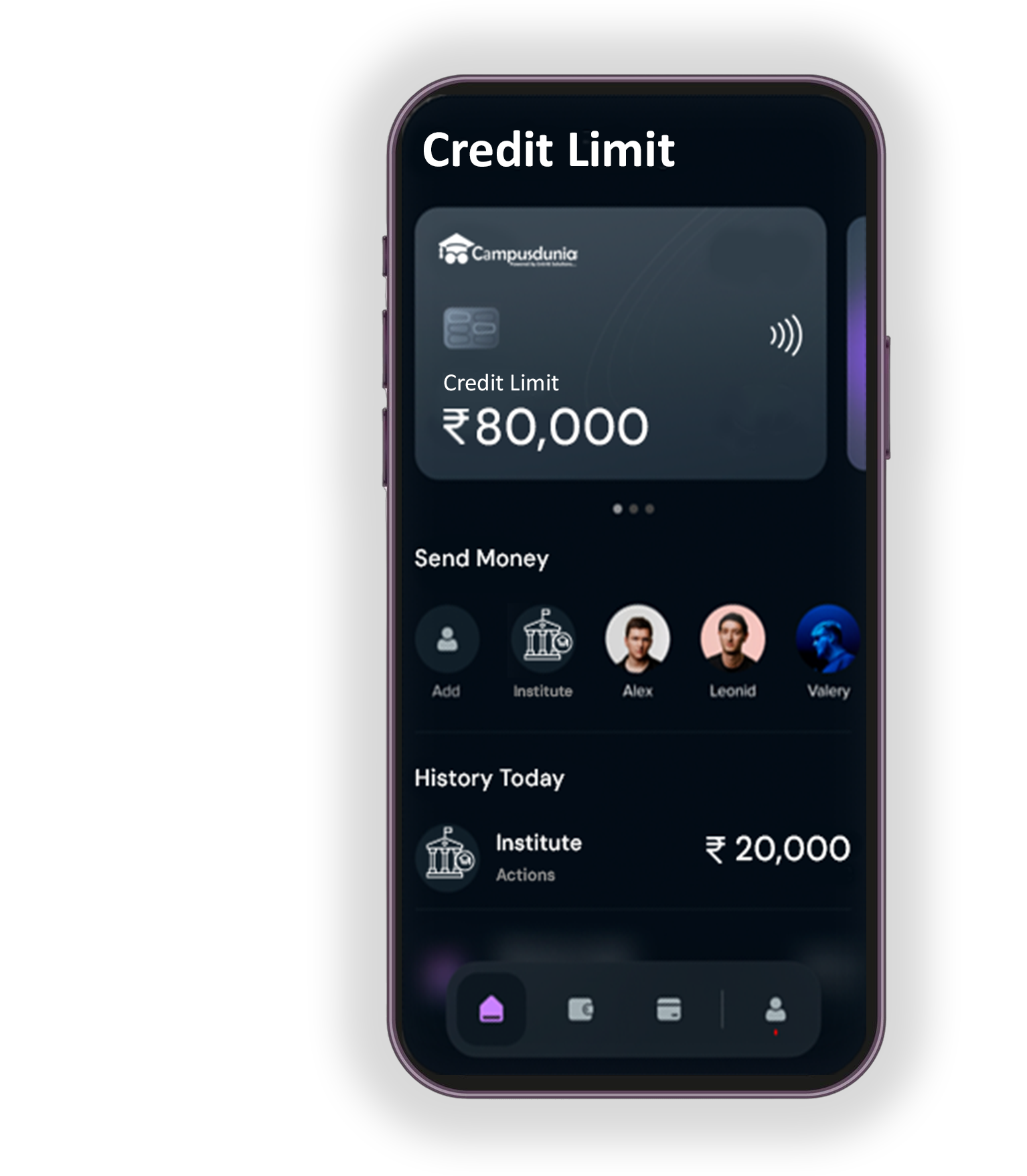

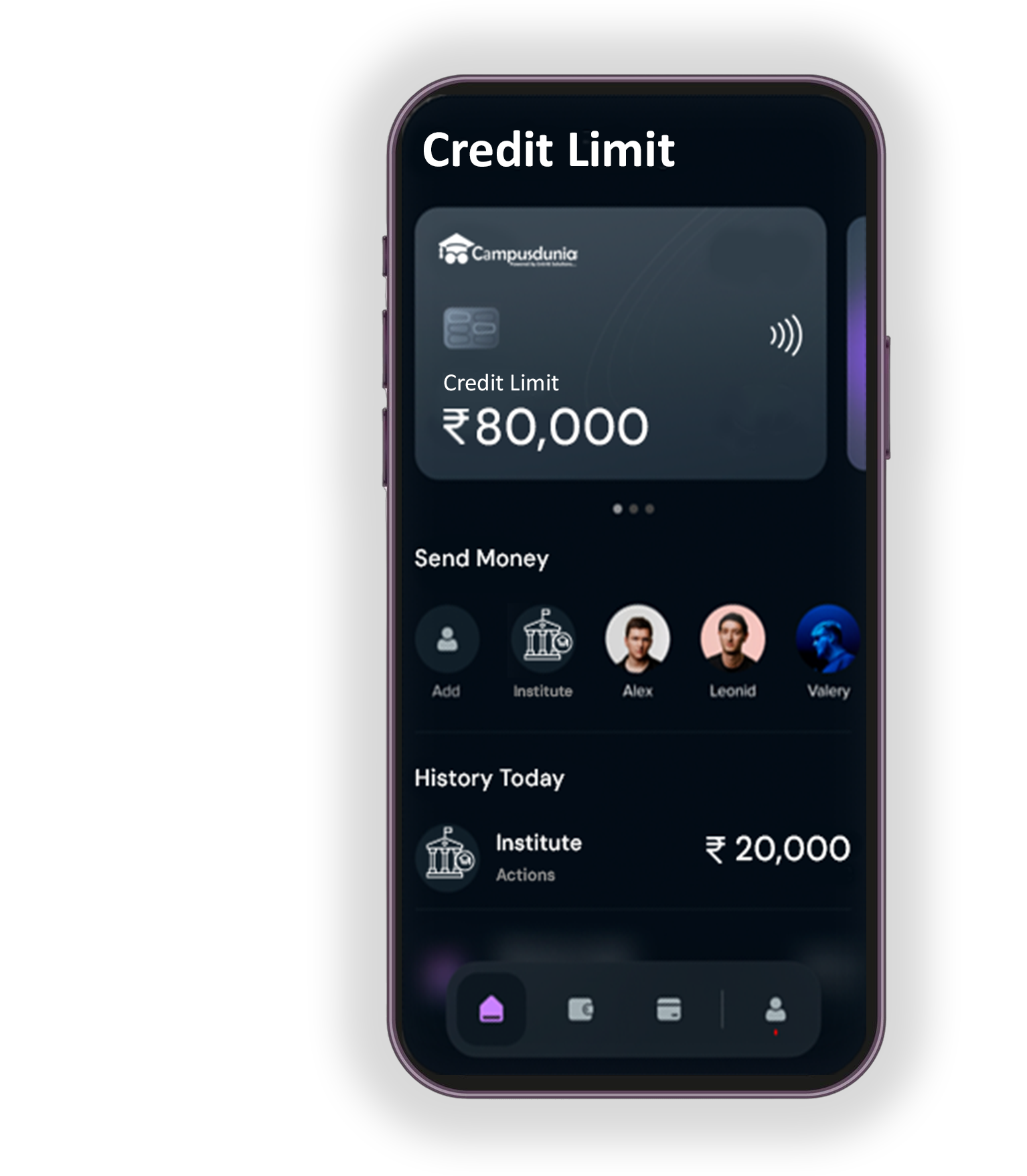

CampusDunia Instant Credit Limit

Spend smart with 0% interest, EMIs, and credit growth

Instant credit limit to meet all the expenses with flexible repayment option

Get instant credit to buy courses or pay bills and services from the comfort of your home

Avail amount as per your need & repay only what you use with an Easy EMI Option

Flexible repayment option begins at 3 months that lasts upto 12 months

Pay for services and bills and earn exciting rewards and free vouchers from our merchant partners

Our alternative data credit score approves customers without credit histories.

Credit line from ₹2,000 to ₹5,00,000 for all your expenses and needs.

CampusDunia credit line helps GenZ and millennials upskill and grow.

Breaks financial barriers to education, building a productive and secure nation.